Introduction to Volume Rate of Change:

In the world of financial markets, traders are constantly seeking ways to gain insights into market movements and make informed decisions.

Among the plethora of technical indicators available, the Volume Rate of Change (VROC) stands out as a powerful tool for analyzing volume dynamics. In

this blog post, we will delve into what the VROC indicator is, how it is calculated, and how traders can effectively use it to enhance their trading strategies.

What is the Volume Rate of Change (VROC) Indicator?

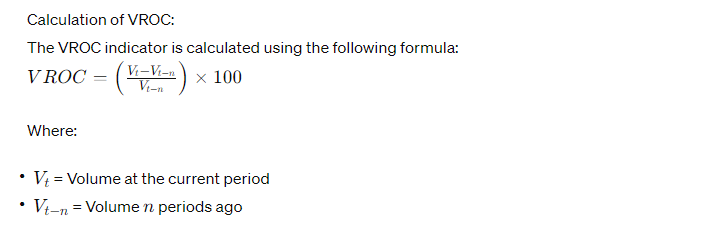

The Volume Rate of Change (VROC) indicator, also known as Volume ROC, is a momentum oscillator that measures the rate of change in volume over a specified period. It is designed to provide traders with insights into the strength or weakness of price movements based on changes in trading volume.

Understanding the Interpretation of Volume Rate of Change – VROC:

The VROC indicator oscillates around a zero line, with positive values indicating an increase in volume compared to the previous period, and negative values indicating a decrease in volume. Traders typically look for divergences between the VROC line and the price action to identify potential trend reversals or continuations.

How to Unse Volume Rate of Change (VROC) in Trading:

Confirming Price Movements: When the VROC indicator moves in the same direction as the price, it confirms the strength of the prevailing trend. For example, if the price is rising and the VROC is also increasing, it suggests strong buying pressure, reinforcing the bullish bias.

Identifying Reversals: Divergences between the VROC and price action can signal potential trend reversals. For instance, if the price is making higher highs while the VROC is making lower highs, it may indicate weakening buying pressure and a possible trend reversal to the downside.

Spotting Breakouts: Sharp increases in volume accompanied by corresponding moves in price can signal breakouts or significant price movements. Traders often use VROC to confirm breakouts and assess the validity of price movements.

Filtering False Signals: VROC can act as a filter to distinguish between genuine price movements and false signals. Traders may wait for confirmation from the VROC indicator before entering or exiting trades to reduce the likelihood of getting caught in false breakouts or reversals.

Limitations of Volume Rate of Change (VROC):

While the Volume Rate of Change indicator is a valuable tool for traders, it is not without limitations. Like any technical indicator, VROC is not foolproof and should be used in conjunction with other analytical tools and risk management strategies. Additionally, VROC may produce false signals during periods of low liquidity or in markets with irregular trading patterns.

Conclusion:

The Volume Rate of Change (VROC) indicator offers traders valuable insights into volume dynamics, helping them make informed decisions in the financial markets.

By understanding how to interpret and use the VROC indicator effectively, traders can enhance their trading strategies, identify potential opportunities, and manage risk more efficiently.

However, like any technical tool, it’s essential to combine VROC with other indicators and market analysis techniques for a comprehensive trading approach. With proper application and careful consideration of its strengths and limitations, VROC can be a valuable addition to any trader’s toolkit.